Over the last two decades, indexing, or passive investment, has become the dominant style of investing for equity portfolios and looks set to grow in importance for other asset classes. A standard feature of indexing is the need for each index to re-evaluate the set of securities whose returns will count towards the index calculation. The major index groups have developed the discipline of enacting these composition changes on a set cycle, often with one large annual change amongst other periodic announcements.

What does 'following the index' entail?

Index portfolios have a beautiful property. Apart from when there are cash flows or changes to the index composition, a well-balanced index fund remains a well-balanced index fund no matter how prices fluctuate. The index portfolio manager's job boils down to managing just those two types of events: cash flows and changes to the index composition. Changes to index composition are known as index rebalances because a fund must buy and sell securities to remain in balance with its index.

Rebalances come in various shapes and sizes. The broadest, most diversified indices, which are also some of the most heavily invested, regularly have rebalances that entail the trading of hundreds of securities entering or leaving the index. The securities involved in a rebalance tend to be difficult to trade because, almost by definition, many will be close to the lower threshold of size or trading volume that qualifies them for the index. So rather than being the kind of securities that can be bought or sold instantaneously, it is common that an index rebalance will include names that will take some patience to trade.

The need to rebalance inevitably incurs some tracking error. The costs of trading a rebalance – be those explicit trading costs, such as paying brokers' commissions to execute orders or implicit trading costs caused by trading around the designated timepoint of the rebalance – cause a difference in performance between the actual portfolio and the index. That difference in performance is usually negative.

The abstract index portfolio incurs no costs when rebalancing. However, there is also the prospect of trading intelligently around rebalances. Index portfolio managers can make a positive performance gain by trading some securities ahead of, or behind, the calculation-point of the index. Such intelligent trading efforts can, if successful, offset negative tracking error and possibly lead to slight outperformance of the fund over the index.

There are different approaches to managing tracking risk. Some portfolios are strictly managed to take 'no risk' – which in effect means that the owners accept the inevitability of negative tracking error – whilst other portfolios are given some tolerance for taking the risk in the hope that offsetting performance can be found. Some portfolio management teams go to the trouble of defining an explicit risk-budget around portfolios. We would consider this to be best practice.

An explicit risk-budget may be defined in a few ways. It is safer to rely on measures of misallocation than using long-run volatility or covariance-based measures. Whilst covariance-based risk models give a useful estimate for active funds which persistently take significant risk, the risk-tolerances are tiny in index management and easily end up being smaller than estimation errors in the model.

Misallocation guideposts may be set such as "a 20bp misweight in a single name is permitted in the five days preceding an index rebalance". We may also set rules at an aggregate level, such as "a maximum of 30bp misweight is permitted on a single industry sector". These rules should be set and monitored by the portfolio management system, giving the whole team and its managers a visual dashboard on where the risk budget is allocated and where it is being used. Such limits leave members of the portfolio management team in no doubt about what discretion they have for seeking positive performance during the period of an index rebalance.

Liquidity and the timing of trades

The decision around trading an index rebalance is primarily one about timing: should I trade early, trade late or trade as close as I can to the rebalance point? This question must be answered for every individual security involved in the rebalance.

Because index rebalances can exhaust the available liquidity for some securities involved, it is advisable to perform a liquidity analysis and tailor a suitable trading strategy. Some funds require the analysis more than others. A microcap fund of decent size will contain many more liquidity constrained securities than a moderately sized large-cap fund. While many funds can safely concentrate their trading around the time of the rebalance, a researched trading strategy will serve to surface any 'problem names' and prepare for them in advance.

Managers usually follow these steps to determine their trading strategy:

- Forecast, or wait for the publication of, the detail of the index rebalance

- Apply those rebalancing rules to the manager's affected portfolios to produce a draft order list in the approximate size that will be required

- Combine these draft orders with average daily volume (ADV) data for the securities being traded

- Estimate, for each security, the number of days average volume that the firm will trade

- Estimate, again for each security, the total amount of money benchmarked against similar benchmarks which will also undergo the same trading pressure in the same time window

- Set a threshold, based on 4 and 5 for the maximum participation rate the manager is prepared to tolerate, which then implies the duration that trading should be spread over. For instance, the manager may plan to trade at a rate no faster than 5 per cent of the ADV. Because one of the index additions she has to buy represents 12 per cent of the ADV, she plans to spread trading over three days.

The steps above give a rough guide on the pace of trading, but it is a rough guide at best. If ever there is a time where long-run average daily volumes are likely to be exceeded, it is around index rebalances. Also, there is no reliable guide on whether trading should be mainly before or mainly after the time point of the index change.

It is difficult to study the effectiveness of different trading strategies systematically, since disclosing a strategy would most likely defeat its purpose. It seems most managers aim to complete the trade by the time the index changes. However, there are also examples of managers purposely doing all their rebalancing after the index change. There is some anecdotal evidence that suggests the 'trading late' approach can produce outcomes just as good as trading early.

Trading 'Market on Close' – the indexer's dilemma

The obvious way to avoid tracking error entirely is to ensure that all your rebalance trades achieve the close prices of the index. You might be tempted to send all your trades to a broker with a MOC – 'Market on Close' instruction. When a broker accepts an illiquid MOC trade it does not usually mean that the broker has willing counterparties to take the other side of the trade immediately. It will take the broker some time to find those counterparties, a process known as sourcing liquidity. The broker may choose to trade patiently to make sure that the broker's demands do not cause adverse price moves. In this way, the portfolio manager is simply outsourcing the job of trading patiently to the broker. The portfolio manager pays the broker a fee for doing a job the portfolio manager would otherwise need to do.

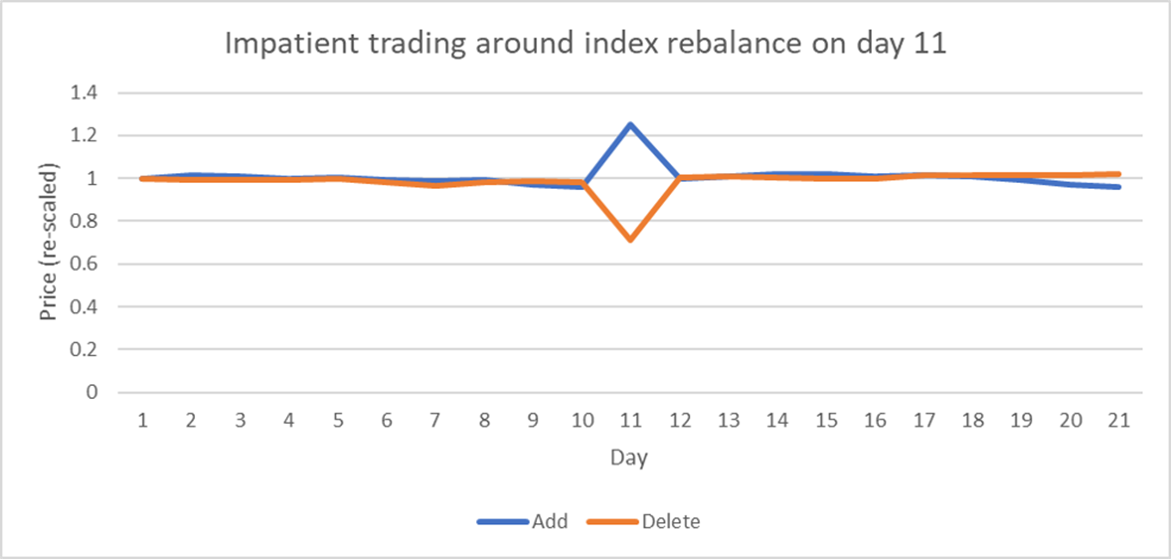

However, this sets up a form of agency problem. What happens if the broker does not trade in the best interests of the fund, i.e. the broker rushes the trade and creates adverse price movements? At the point of the index rebalance we would expect the price of the index additions to rise abnormally (to encourage holders to sell) and the prices of index deletions to drop abnormally (to encourage others to buy). The prices achieved by the index fund are unfavourable which impairs the performance relative to competitors and active funds.

So, although MOC trading does lead to zero tracking error versus the index, it may cause market impact, which will make the entire index underperform when compared to strategies prepared to take some risk. This is the indexer's dilemma: doing the 'no risk' option allows other market participants to trade against indexers. Hence it eats away at the attraction of indexing as a fair and risk-managed way of earning a risk premium. All indexers know that trading intelligently is vital. It's OK to call indexing passive, but don't ever think that means dumb!

Pro-formas and index projections

Index trades are some of the most complex there are. It is important for index fund managers to analyse index rebalances and plan for them in advance. Practically all index vendors give advance notice of forthcoming changes. Some, such as FTSE and MSCI, have long-established services which go into great detail about changes happening in upcoming days. At a minimum, an index vendor should be able to provide a "pro-forma" index ahead of a change.

The pro-forma is the index imagined with the forthcoming changes applied. It contains the new additions, removes the deletions, makes any other adjustments which are part of the change, but the index calculations all use current data. Clearly, the actual calculation of the future index cannot take place ahead of time.

People ask us if we support pro-forma indexes, and of course, we do. However, we at Ryedale prefer a slightly more sophisticated way to look at index rebalances. The weakness of a pro-forma index is that it just tells you what the index composition will be after the change. This makes it inflexible in a couple of situations:

- When lack of liquidity makes it desirable to break the rebalance down into smaller trades happening over a period. The pro-forma can show the final destination but does not offer a roadmap for the trade.

- When other unforeseen index changes happen in the period immediately before the planned rebalance. For example, the completion of a corporate merger may see an addition and/or a deletion happen at short notice. The pro-forma is often constructed before the unforeseen changes are announced, and there can be confusion as to whether it includes those changes or not.

We use projections as the main tool for managing index rebalances. Projections allow us to specify just the changes to an existing index, rather than to create an entirely new index. It is a better way to manage rebalances because it allows for separating out trades into phases.

To better understand the benefits of projections, consider a team preparing for a multi-day index rebalance. If A is the index now, and B is the index as it will be, the pro-forma allows you just to manage the whole change in one gulp.

A → B

The Ryedale projection methodology is to view the index change as an incremental change, Δ.

A + Δ = B

And then Δ can be decomposed, if necessary, into tranches mapping out a trading strategy.

Δ = Δ1 + Δ2 + Δ3

The result is that the whole portfolio management team can see the complex trade mapped out in advance and has the right tools to execute the strategy with assurance.

Planning and executing an index rebalance is not straightforward. The manager of a small fund should think out a strategy with an eye to reducing the tracking error for the fund. The managers of huge index fund complexes need to work hard to avoid moving the market – something that, if it occurs frequently, will damage the entire cohort of index investors. The rebalance is also the time where operating errors – trading instructions that simply go awry – is most likely to happen. A portfolio management system that truly supports rebalances, as Ryedale's does, helps in planning and error-free execution of these complex trades, which makes it an essential tool for a professional index manager.

Disclaimer

Ryedale publications do not offer investment or trade advice or make recommendations to use any particular investment strategy. Should you undertake any such activity on the basis of information contained in Ryedale publications, you do so entirely at your own risk, and Ryedale shall not be held responsible for any loss, damage, costs or expenses incurred by you as a result.

The information we publish has been derived from or is based on sources that we consider to be accurate and primary. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. You should always carry out your own independent verification of information and seek a professional advisor before making any investment decisions.