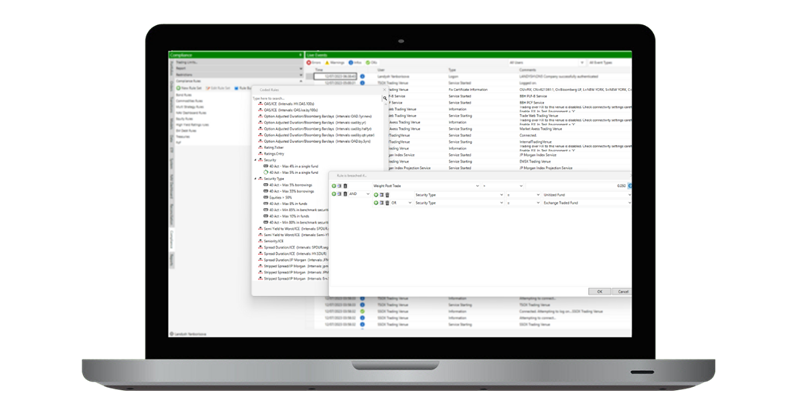

Ryedale's Rules Engine runs continuously during portfolio management processes and produces visual alerts about rule breaches as they occur. This allows immediate remedial action.

The result is ‘continuous compliance’ rather than ‘point-in-time compliance’. The same engine may be used to produce point-in-time compliance reports: pre-trade, in-trade, post-trade and end-of-day.

Solution capabilities

- Hundreds of built-in rules, including 40-Act, UCITS.

- Users can code new rules or customize existing ones.

- Rules based on any combination of security attributes, including weights and tolerances.

- Security restrictions.

- Automatic, rule-based restrictions.

- Concentration limits.

- Users can customize the severity of rule breaches (hard-stop, warning, informational).

Examples

Ensure that no more than 50% of a fund’s value is concentrated in issuers whose weight is more than 5% of the fund.

Automatically restrict trading on securities undergoing certain types of corporate action. For example, securities undergoing rights issues can automatically be marked as "No Sell".

Force a market execution to go to an exception processing workflow if the execution price is more than 3% away from the last known price.

Ryedale's Compliance Solution

Ryedale's Compliance Solution

Contact us to learn more.

IBOR | Index Portfolio Management | Order Management | Asset Allocation | Transition Management | ETF Basket Management